Op-Ed – By Doug Gladstone

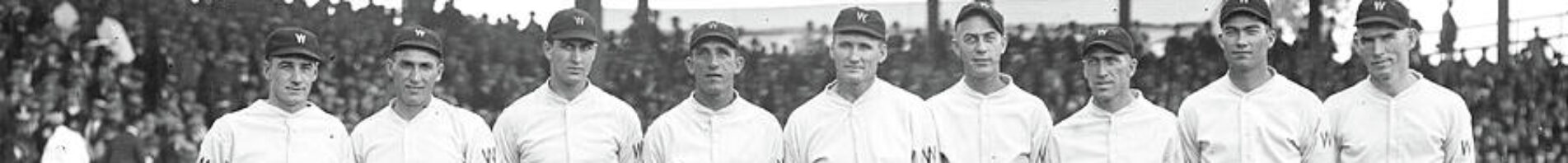

Naples’ Don Leppert made the All-Star Game in 1963, when he was a member of the Washington Senators.

Too bad he isn’t being treated like an All-Star now.

Leppert, who resides on Sunrise Cay, was part of a generation of men who helped grow the game and usher in free agency. Nonetheless, he is one of the 644 retirees who do not receive a Major League Baseball (MLB) pension for their playing time.

Though he receives a MLB pension for having coached in “The Show” for 18 years – with the Pittsburgh Pirates, Toronto Blue Jays and Houston Astros — he only spent 3 1/2 years in the game as a player, from 1961-1964. In 532 plate appearances, he collected 122 hits, including 22 doubles, two triples and 15 home runs. One of those home runs reportedly came on the first pitch he ever saw in the majors.

Nicknamed “Popeye,” Leppert doesn’t receive a traditional pension for his time as a big league catcher because the rules for receiving MLB pensions changed in 1980. Leppert and the other men do not get pensions because they didn’t accrue four years of service credit. That was what ballplayers who played prior to 1979 needed to be eligible for one.

Instead, since April 2011, they have all been receiving what are referred to as non-qualified retirement payments.

For every quarter of service a man has accrued, which is defined as 43 game days of service on an active MLB roster, he gets $625.

And here’s the kicker — the payment they get cannot be passed on to a widow, loved one or other designated beneficiary. When the man passes, the payment passes with him.

By contrast, the maximum allowable pension a retired MLB player who is vested can make is $220,000.

I had the opportunity to speak to Leppert on the Opening Day of the 2018 season. He honestly doesn’t recall whether or not his coaches’ pension increased in 2011, when the non-vested players received their first payment. “I don’t recall what I had for breakfast this morning,” he joked.

But he agreed that, if he’s due any retroactive monies, he wants to receive a payment sooner rather than later. After all, he turns 87 in October.

The league – which does not have to address this matter unless the Major League Baseball Players Association (MLBPA) broaches it in collective bargaining negotiations — recently announced that its revenue was up 325 percent from 1992, and that it has made $500 million since 2015. What’s more, the average value of each of the 30 clubs is up 19 percent from 2016, to $1.54 billion. So the national pastime is in good shape financially.

The MLBPA has been loath to divvy up anymore of the collective pie. Even though Forbes recently reported that the current players’ pension and welfare fund is valued at $2.7 billion, MLBPA Executive Director Tony Clark— the first former player ever to hold that position — has never commented about these non-vested retirees, many of whom are filing for bankruptcy at advanced ages, having banks foreclose on their homes and are so sickly and poor that they cannot afford adequate health care coverage.

Unions are supposed to help hard working women and men in this country get a fair shake in life. But the so-called MLBPA labor leader doesn’t seem to want to help anyone but himself — Clark receives a MLB pension AND an annual salary of more than $2.1 million, including benefits, for being the head of the union.

Now does that seem fair to you?

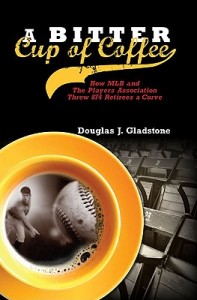

Douglas J. Gladstone is a freelance magazine writer who authored “A Bitter Cup of Coffee: How MLB & the Players’ Association Threw 874 Retirees a Curve.” His website is www.gladstonewriter.com